georgia ad valorem tax family member

Jun 30 2022 In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. This calculator can estimate the tax due when you buy a vehicle.

Required Documents To Be Produced Pdf Fpdf Docx Georgia

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

. Jul 03 2022 Suppose the car is within the TAVT system. To calculate the sales tax on your vehicle find the total sales tax fee for the city. In that case the family member can pay a reduced TAVT rate of 05 of the vehicles fair market.

These taxes have been. Jan 14 2015 1. The minimum is 725.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Jun 24 2013 Effective March 1 2013 motor vehicles purchased in the state of Georgia are exempt from sales and use taxes and annual ad valorem taxes. STATE OF GEORGIA GEORGIA HOUSE BILL 386 New Ad Valorem Title Tax TAVT HB 386 OCGA.

Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. How to register as a ceo in gta 5 solo. Jan 31 2022.

GA Code 48-5-47 - 65 Years of Age and Low Income Exemption Individuals 65. 48-5B-1 The motor vehicle portions of this bill provide as follows. Jun 24 2013 Effective March 1 2013 motor vehicles purchased in the state of Georgia are exempt from sales and use taxes and annual ad valorem taxes.

Homes for sale port. Texas merp exemptions. Jan 14 2015 1.

Vehicles purchased on or after March 1 2013. Vehicle titles transferred between family. The family member who is titling the vehicle is.

English grade 9 textbook. Magnavox 1080p mini action dash camera. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation.

Beaufort county delinquent tax sale list 2022. Answers on Georgia Title Ad Valorem Tax TAVT download Report Transcription. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

Georgia ad valorem tax family member. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Family transfer - Form MV-16 Affidavit to Certify Immediate Family Relationship required.

Werner 6ft ladder lowe39s. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015.

Psa Regarding Title Ad Valorem Tax When Purchasing From Immediate Family Member R Atlanta

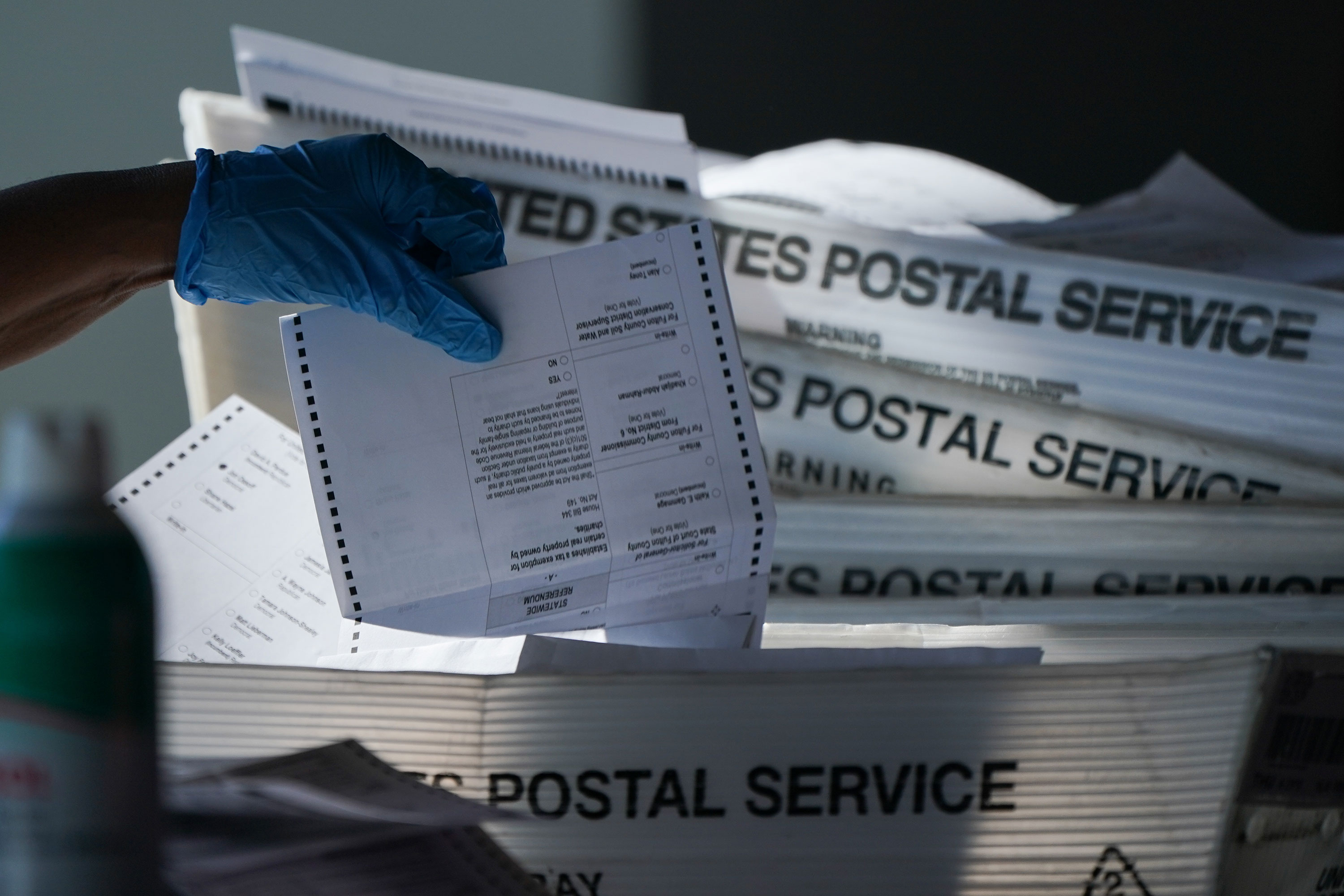

Dekalb Election Sample Ballot Where To Vote What To Know 11alive Com

Free Family Member Lease Agreement Template Pdf Word Eforms

Tag Office Coweta County Ga Website

Tangible Personal Property State Tangible Personal Property Taxes

Gifting A Car In Georgia Getjerry Com

State And Local Tax Receipts Continue To Improve Eye On Housing

Sample Ballots Douglas County Ga

Vehicle Taxes Dekalb Tax Commissioner

2022 Property Taxes By State Report Propertyshark

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application

Myths Facts Georgia Heirs Property Law Center

Vehicle Taxes Dekalb Tax Commissioner

94 Democrats May Need To Win Both Senate Races In Georgia To Flip The Senate